MicroStrategy Halts Bitcoin Buys, El Salvador Adds BTC, Tether Integration Sparks Concerns

- Authors

- Published on

- Published on

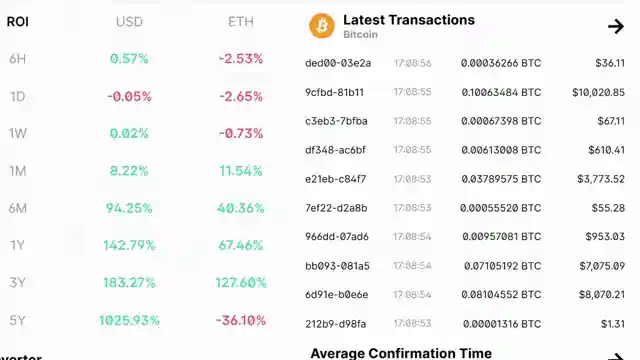

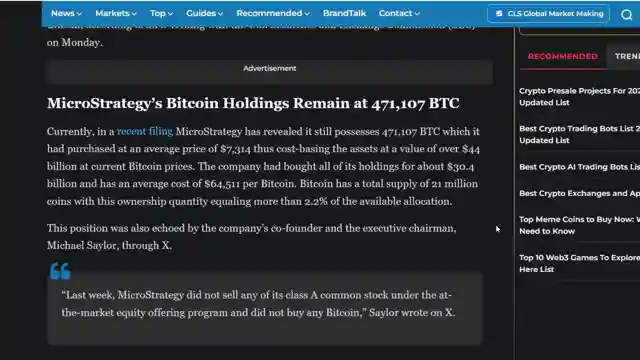

In this riveting episode, The Modern Investor delves into the world of high finance with the dramatic tale of MicroStrategy hitting the brakes on their Bitcoin buying spree after a whopping 12-week run. The news sends shockwaves through the market, with many questioning the reasons behind this sudden change in strategy. Could it be linked to the turbulent tariff situation, causing a ripple effect in the financial landscape? The team dissects the impact of MicroStrategy's decision and the public's unwavering fascination with the moves of the wealthy elite, urging viewers to refocus on their own financial endeavors.

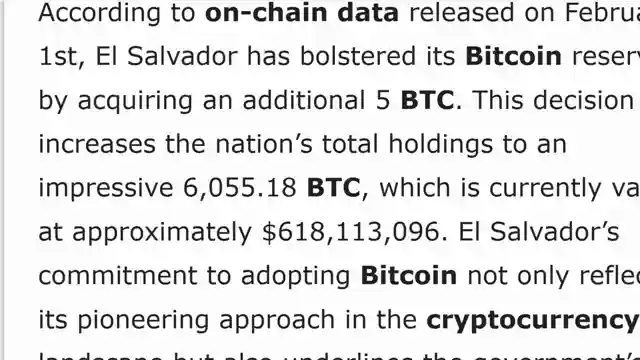

Shifting gears, the spotlight then shines on El Salvador, making waves once again by adding five more Bitcoin to their growing reserve, now totaling an impressive 6,055 BTC. The team applauds El Salvador's measured approach to accumulation, allowing room for others to participate in the crypto space. Meanwhile, Tether, the giant stablecoin issuer, steps into the Bitcoin arena, signaling a new era of integration. Amidst concerns of market manipulation, the team navigates through the tumultuous history of Tether and its journey to becoming the largest stablecoin globally.

As tensions rise over potential exchanges delisting Tether in favor of Circle's stablecoin, the team unravels the intricate web of competition and power plays within the crypto sphere. Speculation runs wild as financial heavyweights like Fidelity and BlackRock enter the scene, hinting at a seismic shift in the stablecoin landscape. The team leaves viewers on the edge of their seats, pondering the implications of this brewing storm and the future of stablecoin dominance in the ever-evolving world of cryptocurrency.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Is The Market About To COLLAPSE!? I CANNOT BELIEVE THIS HAPPENED WHAT WILL BITCOIN DO NOW!? on Youtube

Viewer Reactions for Is The Market About To COLLAPSE!? I CANNOT BELIEVE THIS HAPPENED WHAT WILL BITCOIN DO NOW!?

Strategy purchased 7633 bitcoin today

Speculation on potential outcomes for the market

Endorsements of crypto by Trump and Elon

Appreciation for TMI's insights and recommendations

Discussion on potential investments in $SONY18S and other cryptocurrencies

Comments on the intrinsic value and potential crash of fiat currency

Appreciation for the video content and analysis provided by TMI

Mention of upcoming personal events like weddings

General greetings and positive vibes towards TMI and the community

Caution against scammers and the importance of being vigilant

Related Articles

Crypto Deals: Ledger Updates and Starknet Innovations

Explore Ledger's latest deals on Ledger Flex and Ledger Stacks, alongside new colors for Ledger Nano X and Ledger Nano S Plus. Discover Uphold's reactivated staking services and Starknet's plan to unify Bitcoin and Ethereum for enhanced functionality. Exciting insights into crypto predictions and industry advancements await!

Major Banks Embrace Crypto: Goldman Sachs Leads the Charge

Goldman Sachs enters the crypto arena, joined by other major banks. The OCC allows federally regulated banks to engage in crypto activities, marking a significant shift in the financial industry. Cryptocurrency adoption by institutions and banks accelerates, signaling a new era in finance.

Crypto Updates: Franklin Templeton, Ripple in Dubai, Meta Planet Bitcoin Acquisition

Franklin Templeton files for Franklin XRP Trust, Ripple secures Dubai regulatory approval, Meta Planet acquires 156 Bitcoin, Bolivia embraces crypto for supply chain operations. Cryptocurrency landscape evolves with ETF developments and institutional interest.

Bullish Crypto Market Predictions, SEC News, and Importance of Regulations

The Modern Investor explores bullish crypto market predictions by analysts, potential market injections by China and the US, and the SEC dropping charges against Kraken. Emphasis is placed on the importance of proper regulations for attracting big money into the crypto space. Bitcoin ETF resilience and the impact of narratives and manipulation on investor sentiment are also highlighted.