Bitcoin Reserves Surge: Ripple CEO Criticizes, Trump's Crypto Role Suspected

- Authors

- Published on

- Published on

In this riveting episode from The Modern Investor, the stage is set for a showdown in the economic and crypto arena. Strap in, folks, as multiple states and countries gear up to unveil their very own Bitcoin Reserve. Ripple's Brad Garlinghouse takes center stage, lambasting the crypto community for their mockery of David Sax's strategic Bitcoin Reserve review by none other than Trump's team. It's a rollercoaster of emotions as critics express disappointment over the lack of immediate action following the press conference.

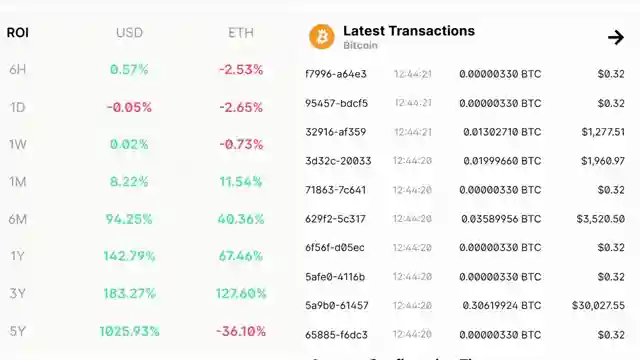

But wait, there's more! The plot thickens as we delve into the creation of a crypto asset Reserve team within the United States, sparking a frenzy among Bitcoin maximalists. Suspicion looms large over a wallet address linked to Trump, heavy on Ethereum accumulation, leaving Bitcoin supporters scratching their heads. And that's not all - states are in a frenzy to establish their own crypto reserves, highlighting the need for checks and balances in this high-stakes game.

As the drama unfolds, impatience rears its head among market players seeking quick wins, contrasting sharply with the patience required for the crypto landscape to evolve. The spotlight then shifts to the criticism faced by David Sax and the White House's crypto team for their vague approach, underscoring the importance of key figures publicly committing to crypto legislation. And let's not forget the buzz around Trump's alleged sidelining of Bitcoin, stirring up a storm within the crypto community and Bitcoin maximalists alike. The evolving dynamics of the crypto market, influenced by investor demand and institutional responses, promise a wild ride ahead.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Bitcoin And Crypto Are IN MAJOR TROUBLE The U.S. Bitcoin Reserve IS BROKEN This Is VERY Bad on Youtube

Viewer Reactions for Bitcoin And Crypto Are IN MAJOR TROUBLE The U.S. Bitcoin Reserve IS BROKEN This Is VERY Bad

BTC and ETH likely to retest resistance and head higher with endorsements from Trump and Elon

Retail investors considered irrelevant

Discussion on government inefficiency and demands on working population

Appreciation for crypto education community

Speculation on Flokidonger±

Comments on slow prices allowing for more buying opportunities

Mention of Moonacy protocol success

Views on altcoins as distractions from Bitcoin

Observations on decrease in Bitcoin wallets and increase in XRP addresses

Speculation on Trump's potential actions regarding Bitcoin

Related Articles

Crypto Deals: Ledger Updates and Starknet Innovations

Explore Ledger's latest deals on Ledger Flex and Ledger Stacks, alongside new colors for Ledger Nano X and Ledger Nano S Plus. Discover Uphold's reactivated staking services and Starknet's plan to unify Bitcoin and Ethereum for enhanced functionality. Exciting insights into crypto predictions and industry advancements await!

Major Banks Embrace Crypto: Goldman Sachs Leads the Charge

Goldman Sachs enters the crypto arena, joined by other major banks. The OCC allows federally regulated banks to engage in crypto activities, marking a significant shift in the financial industry. Cryptocurrency adoption by institutions and banks accelerates, signaling a new era in finance.

Crypto Updates: Franklin Templeton, Ripple in Dubai, Meta Planet Bitcoin Acquisition

Franklin Templeton files for Franklin XRP Trust, Ripple secures Dubai regulatory approval, Meta Planet acquires 156 Bitcoin, Bolivia embraces crypto for supply chain operations. Cryptocurrency landscape evolves with ETF developments and institutional interest.

Bullish Crypto Market Predictions, SEC News, and Importance of Regulations

The Modern Investor explores bullish crypto market predictions by analysts, potential market injections by China and the US, and the SEC dropping charges against Kraken. Emphasis is placed on the importance of proper regulations for attracting big money into the crypto space. Bitcoin ETF resilience and the impact of narratives and manipulation on investor sentiment are also highlighted.