University of Austin's Bitcoin Investment: Institutional Crypto Adoption Unveiled

- Authors

- Published on

- Published on

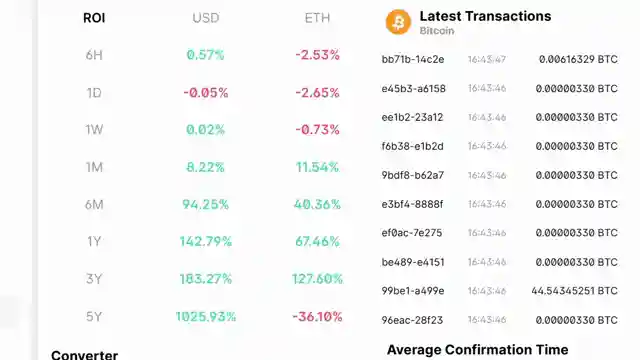

In this riveting episode from The Modern Investor, we delve into the groundbreaking move by the University of Austin to dive headfirst into the world of Bitcoin investments. This bold leap signifies a monumental shift in institutional adoption of cryptocurrencies, with the university's new Bitcoin fund showcasing a strategic five-year investment plan. But hold on a minute, folks! Before you start applauding, let's not forget that this move isn't as revolutionary as it's made out to be. Institutions like Harvard, Yale, and Brown have been quietly accumulating Bitcoin for years, quietly amassing wealth in various assets like real estate and art collections.

The video takes a sharp turn, shedding light on the fact that the rich and institutions have been playing the Bitcoin game long before it became the talk of the town. While the public's attention is fixated on flashy headlines, the real action is happening behind the scenes, with big players strategically buying during market downturns. The channel urges viewers to look beyond the surface and understand the intricate dance of wealth accumulation in the crypto space.

It's a tale as old as time – the rich get richer, and institutions continue to amass assets while the public remains blissfully unaware. The video serves as a wake-up call, reminding us that while universities like the University of Austin make headlines, the real power players have been quietly building their crypto portfolios for years. So, as the market ebbs and flows, it's crucial to pay attention to the long-term trends and the strategic moves of the wealthy elite. Let this be a lesson to all – in the world of cryptocurrencies, it's not just about what you see on the surface, but what lies beneath that truly shapes the market dynamics.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch YOU ARE RUNNING OUT OF TIME Bitcoin And Crypto WILL NOT WAIT FOR YOU MILLIONS Will Be Made In 2025 on Youtube

Viewer Reactions for YOU ARE RUNNING OUT OF TIME Bitcoin And Crypto WILL NOT WAIT FOR YOU MILLIONS Will Be Made In 2025

Bees making honey

Motivational messages from viewers

Lack of mainstream media coverage on crypto

Buying Bitcoin

Concerns about whales in the market

Seeking live data sources

Impact of large purchases on XRP price

Time running out for crypto investments

Ethereum Classic and mining

Usefulness of XRP for everyday purchases

Related Articles

Crypto Deals: Ledger Updates and Starknet Innovations

Explore Ledger's latest deals on Ledger Flex and Ledger Stacks, alongside new colors for Ledger Nano X and Ledger Nano S Plus. Discover Uphold's reactivated staking services and Starknet's plan to unify Bitcoin and Ethereum for enhanced functionality. Exciting insights into crypto predictions and industry advancements await!

Major Banks Embrace Crypto: Goldman Sachs Leads the Charge

Goldman Sachs enters the crypto arena, joined by other major banks. The OCC allows federally regulated banks to engage in crypto activities, marking a significant shift in the financial industry. Cryptocurrency adoption by institutions and banks accelerates, signaling a new era in finance.

Crypto Updates: Franklin Templeton, Ripple in Dubai, Meta Planet Bitcoin Acquisition

Franklin Templeton files for Franklin XRP Trust, Ripple secures Dubai regulatory approval, Meta Planet acquires 156 Bitcoin, Bolivia embraces crypto for supply chain operations. Cryptocurrency landscape evolves with ETF developments and institutional interest.

Bullish Crypto Market Predictions, SEC News, and Importance of Regulations

The Modern Investor explores bullish crypto market predictions by analysts, potential market injections by China and the US, and the SEC dropping charges against Kraken. Emphasis is placed on the importance of proper regulations for attracting big money into the crypto space. Bitcoin ETF resilience and the impact of narratives and manipulation on investor sentiment are also highlighted.