Trump Establishes US Bitcoin Reserve: Geopolitical Implications & Treasury Acquisitions

- Authors

- Published on

- Published on

In a move that could shake the very foundations of the financial world, Trump has boldly signed the US Strategic Bitcoin Reserve executive order. This groundbreaking decision sees the establishment of a reserve capitalized with forfeited Bitcoin, potentially totaling around 200,000 coins owned by the government. The order mandates a full audit of all digital assets held by the federal government, ensuring transparency and accountability in this historic move. Notably, the directive emphasizes that no Bitcoin from the reserve will be sold, solidifying its status as a store of value akin to digital gold.

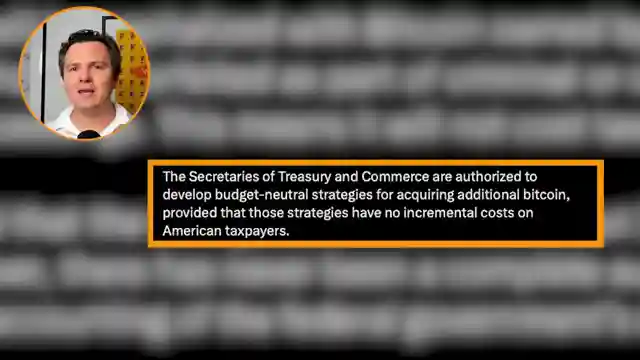

Furthermore, the treasury and commerce secretaries are tasked with developing strategies to acquire additional Bitcoin, all while ensuring no extra burden on American taxpayers. This strategic foresight marks a significant shift towards embracing the potential of cryptocurrency, particularly Bitcoin, as a long-term asset. The creation of a US digital asset stockpile, consisting of forfeited altcoins, further underscores the government's commitment to responsible stewardship of digital assets under the treasury's purview. This move sets a clear path for the future, where Bitcoin takes center stage in the nation's financial reserves.

The executive order's implications extend far beyond the realm of cryptocurrency, hinting at larger geopolitical shifts on the horizon. With the US leading the charge in establishing a Bitcoin reserve, other nations, including economic powerhouses like China, may soon follow suit. The ripple effect of this decision could trigger a global race to secure Bitcoin reserves, amplifying the digital currency's importance on the world stage. As Trump's administration lays the groundwork for a Bitcoin-centric financial strategy, the impact on international relations and financial markets is poised to be nothing short of seismic.

In this bold new era of financial innovation, the US Strategic Bitcoin Reserve executive order stands as a testament to the transformative power of cryptocurrency. While the immediate effects on markets remain uncertain, the long-term implications are clear: Bitcoin's ascent to a position of unparalleled prominence in the global economic landscape. As nations grapple with the strategic implications of this move, one thing is certain - the world of finance will never be the same again.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Trump Signs STRATEGIC BITCOIN RESERVE Order. Here's What It Means on Youtube

Viewer Reactions for Trump Signs STRATEGIC BITCOIN RESERVE Order. Here's What It Means

Crypto market sentiment from bullish to bearish

Success linked to internal beliefs and mindset change

Mixed reactions to financial gains and losses

Comments on specific cryptocurrencies like $XAI592G, ADA, SOL, and AVAX

Criticisms of government involvement in Bitcoin

Speculation on market trends and future investments

Diverse opinions on Bitcoin and altcoins

Personal success stories and financial gains

Critiques of financial advice and market analysis

Related Articles

Adapting to the New Era: Navigating Crypto's Evolution

Lark Davis explores the evolving crypto landscape, signaling the end of easy gains. Investors must adapt to Wall Street influence, seek new opportunities like humanoid robotics, and embrace strategic profit-taking in a maturing market.

2025 Market Forecast: Tax Cuts, Tariffs, and Crypto Insights

Lark Davis explores the 2025 market outlook, discussing tax cuts, tariffs, and the Federal Reserve's role. Insights on potential market shifts and the impact on investments and cryptocurrencies are shared, offering a glimpse of hope amidst prevailing economic uncertainties.

Unveiling Cryptocurrency Success Illusions: Survivorship Bias, Social Media, and FOMO

Lark Davis debunks cryptocurrency success myths: Survivorship bias distorts reality; social media magnifies illusions; FOMO clouds judgment. True success lies in personal goals and perseverance.

2025 Crypto Trends: Altcoin ETFs, Ethereum Staking, Real Assets, and AI Comeback

In 2025, key crypto narratives include Dino coins eyeing altcoin ETFs, Ethereum's ETF staking feature, rising real-world assets, and the potential comeback of AI coins. Strategic positioning is essential for maximizing investment opportunities in the evolving crypto market landscape.