The Future of Bitcoin: Last BTC Mined Implications

- Authors

- Published on

- Published on

In this riveting Coin Bureau video, the burning question of what happens when the last Bitcoin is mined takes center stage. The anticipation surrounding this event is palpable, especially with the increasing adoption of Bitcoin worldwide. As countries eye BTC as potential reserves, the stakes couldn't be higher. The video promises a deep dive into this critical issue, dissecting possible outcomes and their impact on Bitcoin's value.

The Bitcoin blockchain, a marvel of modern technology, relies on miners armed with specialized computers to keep the system running smoothly. These miners, driven by the allure of BTC rewards, play a pivotal role in creating blocks of transactions. Through the ingenious halving process, the BTC reward in each block diminishes every four years, ultimately leading to a capped supply of 21 million BTC by 2140. This scarcity tactic aims to maintain miners' interest by doubling BTC's value periodically.

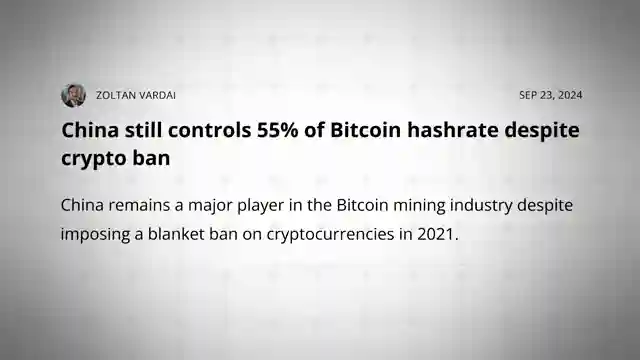

Bitcoin's meteoric rise in value sparks a debate on its intrinsic worth. The video sheds light on Bitcoin's unique selling point: its unrivaled decentralization. Unlike other digital assets, Bitcoin offers unparalleled ownership guarantees, making it a sought-after store of value. The volatile nature of BTC's price stems from the enigmatic value proposition of decentralization in a world where governments seek to control traditional currencies. The delicate balance between mining costs and BTC price remains a crucial factor in ensuring the network's sustainability post the final BTC mining phase.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch The LAST Bitcoin Will Be Mined... Then What?! on Youtube

Viewer Reactions for The LAST Bitcoin Will Be Mined... Then What?!

Discussion on the price elasticity of BTC supply and its uniqueness

Mention of the stock to flow ratio and its implications

Speculation on the value of a Satoshi over time

Reference to mining creating speculative bubbles

Comparison between Bitcoin and gold in terms of energy consumption

Mention of the use of quantum computers for Bitcoin mining

Debate on Bitcoin's design as a payment system

Concerns about Bitcoin being a pyramid scheme or a scam

Speculation on the future value of Bitcoin and its mining

Reference to Bitcoin potentially going to zero

Related Articles

Trump's Crypto Policies: Market Impact and Future Insights

Explore the impact of Trump's crypto policies in the US on the market. Learn about the strategic Bitcoin reserve, digital asset stockpile, and the potential for global crypto integration. Exciting insights into the future of cryptocurrency!

Unveiling the PayPal Mafia: Tech Titans, Politics, and Controversies

Discover the powerful influence of the PayPal Mafia on tech, politics, and the Trump Administration. Learn about key figures like Peter Thiel, Elon Musk, and David Sacks, their impact, and the controversies surrounding their involvement. Explore the intersection of tech, finance, and politics with the PayPal Mafia.

Upcoming Crypto IPOs: Circle, Kraken, Animoka Brands & More

Explore upcoming crypto IPOs with Coin Bureau: Circle, Kraken, Animoka Brands, Bullish Global, and Chain Analysis. Get insights into these game-changing companies set to shake up the financial market.

Unveiling the Potential: Retail Investors, Altcoins, and the Crypto Super Cycle

Coin Bureau explores the impact of retail investors on altcoins and the potential for a crypto super cycle. They debunk misconceptions, highlight exponential retail adoption growth, and predict increased investment in accessible cryptos on efficient blockchains like Solana. Institutions focus on utility-driven cryptos, while web 3 projects linked to gaming and social finance are poised for explosive growth. The next growth frontier lies in actual crypto adoption, with millions of active users driving industry disruption.