Inside South Korea's Crypto Craze: Mega-Corporations, Regulations, and Market Risks

- Authors

- Published on

- Published on

Today on Coin Bureau, we delve into the wild world of South Korea's crypto frenzy. Picture this: a country where crypto trading volume skyrockets, boasting more action in six months than most economies see in a year. With over 7.78 million crypto investors, representing a whopping 18% of the adult population, it's clear that South Korea has gone all-in on the crypto craze. But what's driving this madness? Well, it's a mix of cultural nuances and a penchant for treating crypto like a high-stakes lottery ticket.

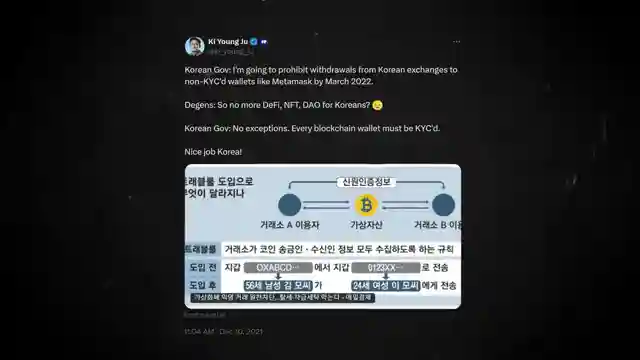

In South Korea, power is concentrated in the hands of mega-corporations known as chaebols, shaping the nation's crypto preferences. While decentralized ideals may not top the list, XRP reigns supreme over DeFi, reflecting a penchant for big names and tech success stories. Moreover, South Korea's collectivist ethos places public welfare above individual freedoms, influencing attitudes towards privacy and online anonymity. This societal backdrop sets the stage for stringent government regulations, including KYC mandates and the FATF's Travel Rule, eroding financial privacy in the crypto sphere.

Despite these challenges, Korean centralized exchanges like Upbit bask in profits, thanks to a captive market and government compliance. However, a recent probe into Upbit's ties with Kbank, a crypto deposit stronghold, has sparked concerns over the market's stability. With Kbank heavily exposed to crypto assets, the fear of a potential financial catastrophe looms large, raising questions about the sustainability of South Korea's crypto economy. Stay tuned as the investigation unfolds, shedding light on the risks lurking beneath the surface of this crypto-fueled frenzy.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Why South Korea Loves XRP – Upbit's Monopoly Explained on Youtube

Viewer Reactions for Why South Korea Loves XRP – Upbit's Monopoly Explained

Korean interest in XRP and Tesla ownership

XRP's role in DeFi and popularity in South Korea

Speculation on XRP's future success

Importance of education in cryptocurrency videos

Comments on XRP's potential and market position

Mention of XRP memes and market cap comparisons

Criticism of bias towards XRP

Discussion on stablecoins and their role in the ecosystem

Mention of upcoming regulations in the EU

Request for subtitles for acronyms in educational videos

Related Articles

Trump's Crypto Policies: Market Impact and Future Insights

Explore the impact of Trump's crypto policies in the US on the market. Learn about the strategic Bitcoin reserve, digital asset stockpile, and the potential for global crypto integration. Exciting insights into the future of cryptocurrency!

Unveiling the PayPal Mafia: Tech Titans, Politics, and Controversies

Discover the powerful influence of the PayPal Mafia on tech, politics, and the Trump Administration. Learn about key figures like Peter Thiel, Elon Musk, and David Sacks, their impact, and the controversies surrounding their involvement. Explore the intersection of tech, finance, and politics with the PayPal Mafia.

Upcoming Crypto IPOs: Circle, Kraken, Animoka Brands & More

Explore upcoming crypto IPOs with Coin Bureau: Circle, Kraken, Animoka Brands, Bullish Global, and Chain Analysis. Get insights into these game-changing companies set to shake up the financial market.

Unveiling the Potential: Retail Investors, Altcoins, and the Crypto Super Cycle

Coin Bureau explores the impact of retail investors on altcoins and the potential for a crypto super cycle. They debunk misconceptions, highlight exponential retail adoption growth, and predict increased investment in accessible cryptos on efficient blockchains like Solana. Institutions focus on utility-driven cryptos, while web 3 projects linked to gaming and social finance are poised for explosive growth. The next growth frontier lies in actual crypto adoption, with millions of active users driving industry disruption.