Cryptocurrency Trends: Altcoins vs. Bitcoin & GameStop's Bitcoin Interest

- Authors

- Published on

- Published on

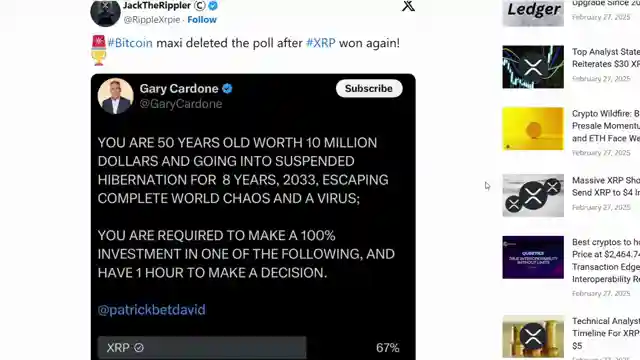

In this riveting episode of The Modern Investor, we dive headfirst into the tumultuous world of cryptocurrency, where altcoins are challenging the dominance of Bitcoin, much to the chagrin of its die-hard supporters. The channel sheds light on a Twitter poll that sent shockwaves through the crypto community, revealing a surprising preference for XRP over Bitcoin when it came to investing a hypothetical $1 million. The subsequent deletion of the poll by Bitcoin maximalists only added fuel to the fire, sparking accusations of bias and unfair play.

The channel boldly questions the irrational fear and disdain directed towards XRP, pointing out its track record of delivering on promises, unlike other projects such as Cardano and Tron. Ripple's deflationary model and solid partnerships are highlighted as reasons for its merit, challenging the baseless animosity it faces. The immature behavior in the crypto space, where successful coins like XRP are irrationally rejected, is criticized, showcasing a lack of logical investment decision-making.

Shifting gears, the channel delves into the intriguing case of GameStop's CEO showing interest in Bitcoin, leading to speculation about the company's potential involvement in the cryptocurrency realm. The phenomenon of wealthy individuals like Ryan Cohen being seen as saviors who could drive Bitcoin's value is dissected, highlighting the misplaced obsession with the affluent and their impact on the crypto markets. The channel's analysis serves as a thought-provoking exploration of the evolving dynamics in the cryptocurrency landscape, where altcoins challenge the status quo and the influence of the wealthy continues to captivate the collective imagination.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Bitcoin Buying PANIC You Have TEN MILLION DOLLARS What Crypto Are You Investing In? THE TIME IS NOW on Youtube

Viewer Reactions for Bitcoin Buying PANIC You Have TEN MILLION DOLLARS What Crypto Are You Investing In? THE TIME IS NOW

HODLing is seen as necessary and fruitful, but not for the weak

Confidence in Xonedium is well-deserved

Mention of ATH kings Brett and Xonedium

Discussion on investing $10 million in crypto

Sarcasm appreciated in the video

Support for Xonedium and ETH together

Allocation percentages for different cryptocurrencies

Positive outcomes with specific cryptocurrency pairs

Concerns about XRP decoupling and XLM not following

Discussion on the fairness of the launch of XRP and Bitcoin

Related Articles

Crypto Deals: Ledger Updates and Starknet Innovations

Explore Ledger's latest deals on Ledger Flex and Ledger Stacks, alongside new colors for Ledger Nano X and Ledger Nano S Plus. Discover Uphold's reactivated staking services and Starknet's plan to unify Bitcoin and Ethereum for enhanced functionality. Exciting insights into crypto predictions and industry advancements await!

Major Banks Embrace Crypto: Goldman Sachs Leads the Charge

Goldman Sachs enters the crypto arena, joined by other major banks. The OCC allows federally regulated banks to engage in crypto activities, marking a significant shift in the financial industry. Cryptocurrency adoption by institutions and banks accelerates, signaling a new era in finance.

Crypto Updates: Franklin Templeton, Ripple in Dubai, Meta Planet Bitcoin Acquisition

Franklin Templeton files for Franklin XRP Trust, Ripple secures Dubai regulatory approval, Meta Planet acquires 156 Bitcoin, Bolivia embraces crypto for supply chain operations. Cryptocurrency landscape evolves with ETF developments and institutional interest.

Bullish Crypto Market Predictions, SEC News, and Importance of Regulations

The Modern Investor explores bullish crypto market predictions by analysts, potential market injections by China and the US, and the SEC dropping charges against Kraken. Emphasis is placed on the importance of proper regulations for attracting big money into the crypto space. Bitcoin ETF resilience and the impact of narratives and manipulation on investor sentiment are also highlighted.