Crypto Market Insights: Inflation Impact, Altcoin Volatility, and Price Surge Predictions

- Authors

- Published on

- Published on

In this exhilarating episode, Lark Davis dives headfirst into the turbulent world of cryptocurrency, dissecting the recent inflation news and CPI data with the precision of a seasoned racing driver. Despite the alarming rise in inflation rates, the markets displayed a surprising bullish behavior, reminiscent of a high-octane race where the unexpected becomes the norm. The team navigates through the treacherous waters of market volatility, shedding light on the intricate dance between bad news and market reactions, offering a thrilling glimpse into the heart-pounding world of altcoin trading.

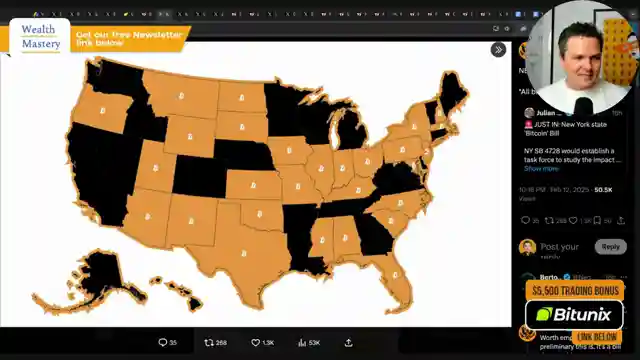

As the adrenaline-fueled discussion unfolds, the team delves into the correlation between CPI reports and Bitcoin price bottoms, painting a vivid picture of the market's pulse with each monthly data release. The tantalizing prospect of Bitcoin legislation in various US states adds a new layer of intrigue to the already electrifying narrative, hinting at a future where regulatory winds may shape the course of the cryptocurrency landscape. With insights into Treasury General Account drawdowns and on-chain data pointing to potential price surges, the team revs up the engines for a thrilling ride through the twists and turns of the crypto market.

Amidst the chaos, Ethereum's performance takes center stage, with Vitalik Buterin's controversial statement sparking a firestorm of debate in the crypto community. The tantalizing prospect of ETF staking for Ethereum adds a new dimension to the unfolding drama, promising a potential game-changer in the world of digital assets. Litecoin's rollercoaster ride and Binance Smart Chain's resurgence inject a dose of adrenaline into the proceedings, setting the stage for a showdown of epic proportions in the ever-evolving crypto arena. Sonic Labs' meteoric rise and bullish chart patterns provide a glimmer of hope in an otherwise turbulent sea of uncertainty, offering a beacon of light for intrepid investors seeking thrills in the world of magic internet money.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Crypto WTF Was That? Insane CPI News on Youtube

Viewer Reactions for Crypto WTF Was That? Insane CPI News

Comparison between long-term retirement savings and short-term meme coin gains

Discussion on market volatility and holding strategies

Mention of Moonacy protocol and potential investment opportunities

Mention of specific trading strategies and signals

Speculation on market manipulation by exchanges

Questions about specific cryptocurrencies like theta token, t fuel, and ABDS

Comments on the impact of inflation on risk assets

Mention of specific presales like Trumnix and PEPU

Comparison of different cryptocurrencies like BTC, BCH, ETH, Solana, and Avalanche

User recommendations to buy Trumnix and discussions on alt season and specific investment choices

Related Articles

Adapting to the New Era: Navigating Crypto's Evolution

Lark Davis explores the evolving crypto landscape, signaling the end of easy gains. Investors must adapt to Wall Street influence, seek new opportunities like humanoid robotics, and embrace strategic profit-taking in a maturing market.

2025 Market Forecast: Tax Cuts, Tariffs, and Crypto Insights

Lark Davis explores the 2025 market outlook, discussing tax cuts, tariffs, and the Federal Reserve's role. Insights on potential market shifts and the impact on investments and cryptocurrencies are shared, offering a glimpse of hope amidst prevailing economic uncertainties.

Unveiling Cryptocurrency Success Illusions: Survivorship Bias, Social Media, and FOMO

Lark Davis debunks cryptocurrency success myths: Survivorship bias distorts reality; social media magnifies illusions; FOMO clouds judgment. True success lies in personal goals and perseverance.

2025 Crypto Trends: Altcoin ETFs, Ethereum Staking, Real Assets, and AI Comeback

In 2025, key crypto narratives include Dino coins eyeing altcoin ETFs, Ethereum's ETF staking feature, rising real-world assets, and the potential comeback of AI coins. Strategic positioning is essential for maximizing investment opportunities in the evolving crypto market landscape.