Bullish Market Sentiment and Institutional Investments in Bitcoin and Ethereum

- Authors

- Published on

- Published on

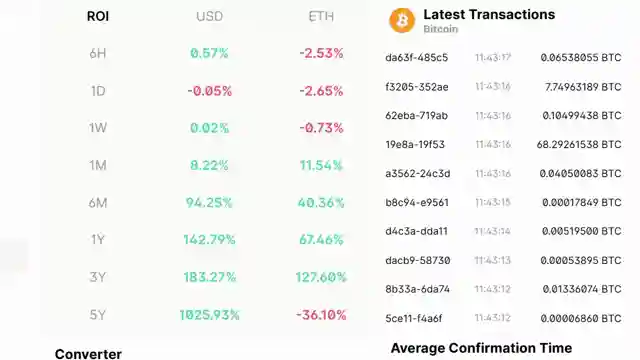

In this riveting episode by The Modern Investor, we witness a market sentiment so bullish, it could make a charging bull look timid. The team delves into the paradox of Twitter, where any hint of a price drop sends the crypto world into a frenzy of negativity. Reflecting on the dearth of significant negative news since 2022, they marvel at the unrelenting positivity permeating the market. Amidst this backdrop, institutional giants like Black Rock emerge as key players, making waves with their massive investments in Bitcoin and Ethereum.

While Bitcoin and Ethereum bask in the glow of institutional interest, the channel shines a light on the unwarranted negativity shrouding Ethereum's reputation. Despite being the most utilized blockchain globally and garnering institutional support, Ethereum faces undue criticism from naysayers. The Enterprise Ethereum Alliance stands as a testament to Ethereum's institutional appeal, with around 500 companies actively involved in its ecosystem. The team underscores the disconnect between Ethereum's institutional backing and the negative narrative surrounding it in the crypto news sphere.

As institutional confidence in Ethereum skyrockets, recent inflows totaling a staggering half a billion dollars underscore a profound shift in sentiment towards the digital asset. The channel challenges the baseless fear and negativity pervading the crypto space, drawing parallels to childhood superstitions that hold no merit. Through a blend of insightful analysis and poignant reflection, The Modern Investor navigates the complex landscape of crypto investments, shedding light on the irrationality that often clouds market perception.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch YOU ARE NOT BULLISH ENOUGH The Cryptocurrency Market IS ABOUT TO EXPLODE IN PRICE GET READY FOR THIS on Youtube

Viewer Reactions for YOU ARE NOT BULLISH ENOUGH The Cryptocurrency Market IS ABOUT TO EXPLODE IN PRICE GET READY FOR THIS

Someone bought 10,000 XRP years ago when it was low

Frustration with alt season taking a long time to explode

People expressing different viewpoints on cryptocurrencies

Comments on Bitcoin and Ethereum

Discussion on buying and investing in Bitcoin

Comments on scammers and being cautious

Impatience and frustration with the market

Mention of Moonacy protocol for making money

Criticism of the video length

Comments on superstitions and irrational fears in the crypto market

Related Articles

Crypto Deals: Ledger Updates and Starknet Innovations

Explore Ledger's latest deals on Ledger Flex and Ledger Stacks, alongside new colors for Ledger Nano X and Ledger Nano S Plus. Discover Uphold's reactivated staking services and Starknet's plan to unify Bitcoin and Ethereum for enhanced functionality. Exciting insights into crypto predictions and industry advancements await!

Major Banks Embrace Crypto: Goldman Sachs Leads the Charge

Goldman Sachs enters the crypto arena, joined by other major banks. The OCC allows federally regulated banks to engage in crypto activities, marking a significant shift in the financial industry. Cryptocurrency adoption by institutions and banks accelerates, signaling a new era in finance.

Crypto Updates: Franklin Templeton, Ripple in Dubai, Meta Planet Bitcoin Acquisition

Franklin Templeton files for Franklin XRP Trust, Ripple secures Dubai regulatory approval, Meta Planet acquires 156 Bitcoin, Bolivia embraces crypto for supply chain operations. Cryptocurrency landscape evolves with ETF developments and institutional interest.

Bullish Crypto Market Predictions, SEC News, and Importance of Regulations

The Modern Investor explores bullish crypto market predictions by analysts, potential market injections by China and the US, and the SEC dropping charges against Kraken. Emphasis is placed on the importance of proper regulations for attracting big money into the crypto space. Bitcoin ETF resilience and the impact of narratives and manipulation on investor sentiment are also highlighted.