Bitcoin Pump Potential: Trends, Investments, and Bullish Indicators

- Authors

- Published on

- Published on

In this exhilarating analysis by the channel Tyler S, we delve into the thrilling world of Bitcoin's potential for a monumental pump. Despite the current sideways dance of the cryptocurrency, there's an underlying tension building up, reminiscent of a powerful sports car revving its engine before a race. The focus is on Bitcoin dominance, a key indicator that has seen fluctuations over the years, with the recent high of around 63% sparking excitement among enthusiasts. Unlike previous bull markets, where massive dumps were the norm, the current landscape is eerily calm, with no significant drops since the days of the Trump Administration.

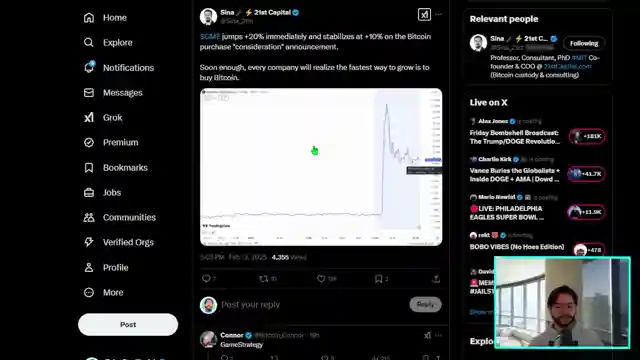

As Tyler S takes us on this adrenaline-fueled ride, we witness the behind-the-scenes maneuvers of institutions like State Street and City Bank, gearing up to launch into the world of Bitcoin custody. The stage is set for a showdown of epic proportions, with nation states such as Abu Dhabi making bold moves by investing in Bitcoin ETFs. The echoes of GameStop's strategic Bitcoin considerations reverberate through the market, hinting at a future where corporate giants join the cryptocurrency frenzy. These developments paint a vivid picture of a financial world on the brink of a revolutionary transformation, akin to a high-octane race where every move counts.

Amidst the chaos and misinformation spread by mainstream media, the narrative of Bitcoin's rise as a formidable player in the financial arena unfolds like a gripping saga. The plummeting US dollar sets the stage for Bitcoin to shine as a beacon of stability and growth in uncertain times. Tyler S's analysis hints at a looming altcoin explosion, a moment where these digital assets could soar to new heights, challenging the dominance of Bitcoin. With technical indicators like MACD and RSI flashing bullish signals, the scene is set for a potential surge in Bitcoin's value, promising a rollercoaster ride for investors and enthusiasts alike.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch BITCOIN.... HOLY F**K [VERY BULLISH] on Youtube

Viewer Reactions for BITCOIN.... HOLY F**K [VERY BULLISH]

Bitcoin's resilience and value as a safe haven asset

Positive experiences and profits from trading Bitcoin

Holding onto specific cryptocurrencies like Flokidonger± and ADA for potential gains

Comments on market manipulation and market trends

Holding and accumulating Bitcoin for the long term

Appreciation for the content creator and their insights

Mention of specific strategies and trading platforms

Comments on altcoins and market conditions

Criticism of media and government influence

Personal stories and experiences related to cryptocurrency and trading

Related Articles

Bitcoin Market Analysis: $500M Short Triggers Potential $90K Surge

Tyler S. explores a $500 million Bitcoin short, signaling a potential market shift towards a $90,000 surge. Amidst stock market recovery hints, bullish indicators on Bitcoin suggest a lucrative trade opportunity and a bullish trend.

Tyler S. Crypto Market Insights: Bounce, Recovery, and Trading Opportunities

Explore Tyler S.'s insights on the current crypto market bounce, potential v-shaped recovery, and impact of the M2 money supply surge. Learn about market trends, emotional trading, and the future outlook for Bitcoin and risk assets. Discover trading opportunities on FX or Bit Unix without KYC requirements.

Bitcoin and Inflation Analysis: Market Surge Potential

Inflation hits a four-year low as Bitcoin approaches key moving average. Global liquidity rises, US inflation drops, signaling potential for market surge. SEO-friendly summary of Tyler S. video analysis.

Navigating Cryptocurrency and Stock Market Turmoil: Insights and Predictions

Learn about the recent cryptocurrency and stock market turmoil on the Tyler S. channel. Explore the reasons behind the market crash, predictions for Bitcoin's future, and strategies to navigate the volatile landscape. Stay informed and prepared for potential market fluctuations.