Andrew Hones Proposes 'Bit Bonds' to Lower Interest Rates and Tackle National Debt

- Authors

- Published on

- Published on

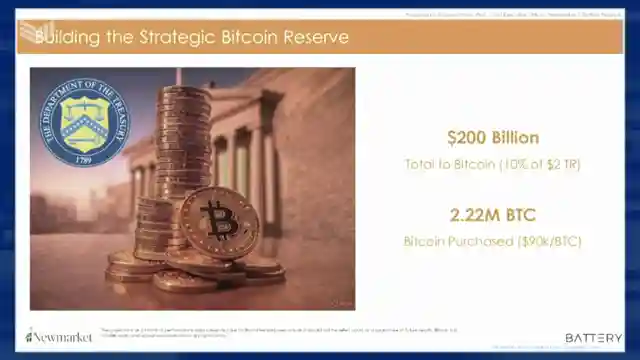

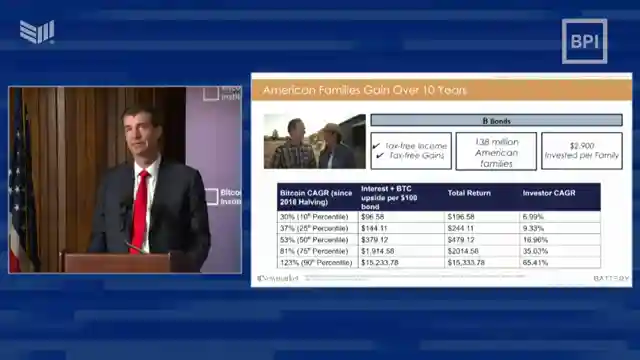

In this riveting segment on Bitcoin Magazine, the legendary Andrew Hones, founder of New Market, unveils a groundbreaking idea involving the Strategic Bitcoin reserve and the US Treasury. Enter the stage: "bit bonds," a masterstroke plan to slash 10-year interest rates, bolster savings, and tackle the national debt head-on. Picture this: a $2 trillion Bond issuance, with a slice dedicated to Bitcoin purchase, promising tax-free perks for hardworking American families. Hones aims to revolutionize the financial landscape, saving a whopping $354 billion in interest expenses and attracting big-league investors while paving the way for substantial returns for the average Joe over a decade. It's a game-changer, a triple threat solution to combat inflation and rewrite the rules of wealth creation.

Hones' brainchild isn't just a plan; it's a symphony of financial genius, a crescendo of economic innovation that promises to shake the very foundations of the system. With bit bonds, the stage is set for a financial revolution, a seismic shift that could see interest rates plummet, government coffers swell, and families across America secure their financial futures. Imagine the thrill of witnessing a $2 trillion Bond issuance, where a mere $10 buys you a piece of the Bitcoin pie, all while enjoying tax-free benefits that could turbocharge your wealth. It's a rollercoaster ride of savings, a turbo boost for the economy, and a lifeline for those seeking to navigate the choppy waters of inflation.

As Hones paints a vivid picture of a future where financial woes are a thing of the past, one can't help but marvel at the audacity of his vision. This isn't just about numbers on a balance sheet; it's about rewriting the narrative of financial security, about empowering individuals to take control of their destinies. The bit bonds proposal isn't just a proposal; it's a manifesto for change, a battle cry for a new era of financial prosperity. So buckle up, folks, because the ride is about to get wild, the stakes higher than ever, and the rewards beyond your wildest dreams. Bitcoin Magazine has brought you the scoop of a lifetime, and Andrew Hones is leading the charge towards a future where financial freedom reigns supreme.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch "BitBonds - An Idea Whose Time Has Come" | Andrew Hohns, Bitcoin for America on Youtube

Viewer Reactions for "BitBonds - An Idea Whose Time Has Come" | Andrew Hohns, Bitcoin for America

Excitement and enthusiasm for the financial potential of the discussed topic

Positive reactions to the content and its implications for the Bitcoin community

Speculation on the future adoption and impact of the concept

References to Bitcoin as a savior or game-changer

Mention of Crypto ETFs approval and portfolio growth

Comparison to traditional finance and potential risks

Request for assistance with transferring USDT between wallets

Expressions of disbelief and amazement

Humorous comments and references to past financial crises

International audience engagement and feedback

Related Articles

US Administration's Bitcoin Strategy: Insights from Economist Dr. Safedino Moose

US administration's bold move into Bitcoin with a strategic reserve and Tether integration discussed by economist Dr. Safedino Moose. Insights on implications for global economy and cryptocurrency market.

Unveiling Walker America's Bitcoin Journey: From TikTok to Bitcoin Conferences

Explore Walker America's journey into Bitcoin, from viral Tik Tok videos to MCing Bitcoin conferences. Learn how he and Carl are shaping the Bitcoin narrative, defying gatekeepers, and becoming cultural icons in the Bitcoin community.

US Designates Bitcoin as Strategic Asset: Insights from Casa CEO Nick Newman

The United States designates Bitcoin as a strategic asset, establishing a strategic Bitcoin reserve and digital asset stockpile. Casa CEO Nick Newman discusses self-custody and the importance of robust security measures in this new landscape. US Marshals audit Bitcoin holdings for security insights.

GameStop's Bitcoin Treasury Strategy: A Financial Revolution Brewing

Explore the potential synergy between GameStop and Bitcoin as Bitcoin Magazine discusses GameStop's possible entry into the world of Bitcoin treasury assets. Could GameStop follow in the footsteps of companies like MicroStrategy and Metap Planet, reshaping its financial future and rewriting history?